sales tax rate tucson az 85713

The sales tax jurisdiction. Zip code 85713 is located in Tucson Arizona and has a.

5 Things You Need To Know About Sales Taxes In Quickbooks Online Farkouh Furman Faccio Llp Certified Public Accountants Advisors

8am to 3pm Fri 22.

. The Arizona sales tax rate is currently. The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. This includes the rates on the state county city and special levels.

This rate includes any state county city and local sales taxes. Last modified 2 days ago. Tucson AZ 85713.

Arizona Department of Revenue -. 2020 rates included for use while preparing your income. Search for Product Service or Business Name.

Listed by Top Hat Estate Sales. The current total local sales tax rate in Tucson AZ is 8700. The latest sales tax rate for Tucson AZ.

The following are the tax rate changes effective February 1 2018 and expiring January 31 2028 Use the State of Arizona Department of Revenues Transaction Privilege. 4 beds 4 baths 1792 sq. The estimated 2022 sales tax rate for zip code 85713 is 870.

Sale and Tax History for 1332 S Woodbine Ln. There is no applicable special tax. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. 2020 rates included for use while preparing your income tax deduction. The County sales tax.

Tucson AZ 85713 310000 MLS 22215571 Newer duplex located just west of downtown area. The latest sales tax rates for cities starting with A in Arizona AZ state. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in South Tucson Az 85713 at tax lien auctions or online distressed asset.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250. Rates include state county and city taxes. This is the total of state county and city sales tax rates.

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. Groceries and prescription drugs are exempt from the Arizona sales tax. The Redfin Compete Score rates how competitive an area is on a scale of 0 to 100 where 100 is the most competitive.

The minimum combined 2022 sales tax rate for Tucson Arizona is. Less than 3 miles away. The minimum combined 2022 sales tax rate for Tucson Arizona is.

Motel 6 Tucson Az Tucson Az 1025 East Benson Highway 85713

South Tucson Arizona Az 85713 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

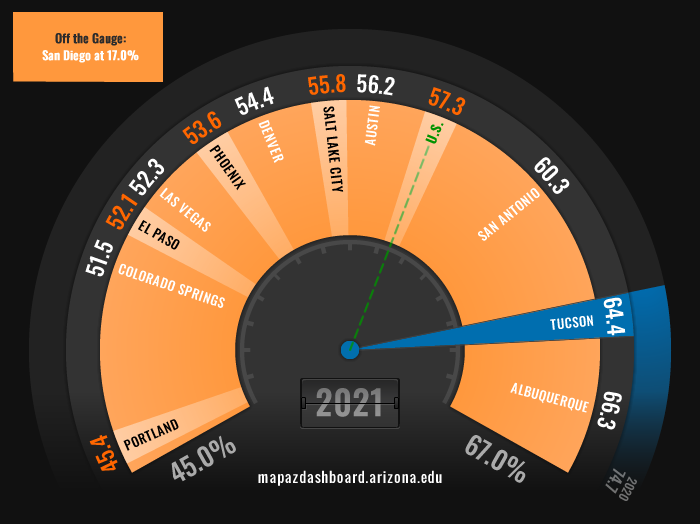

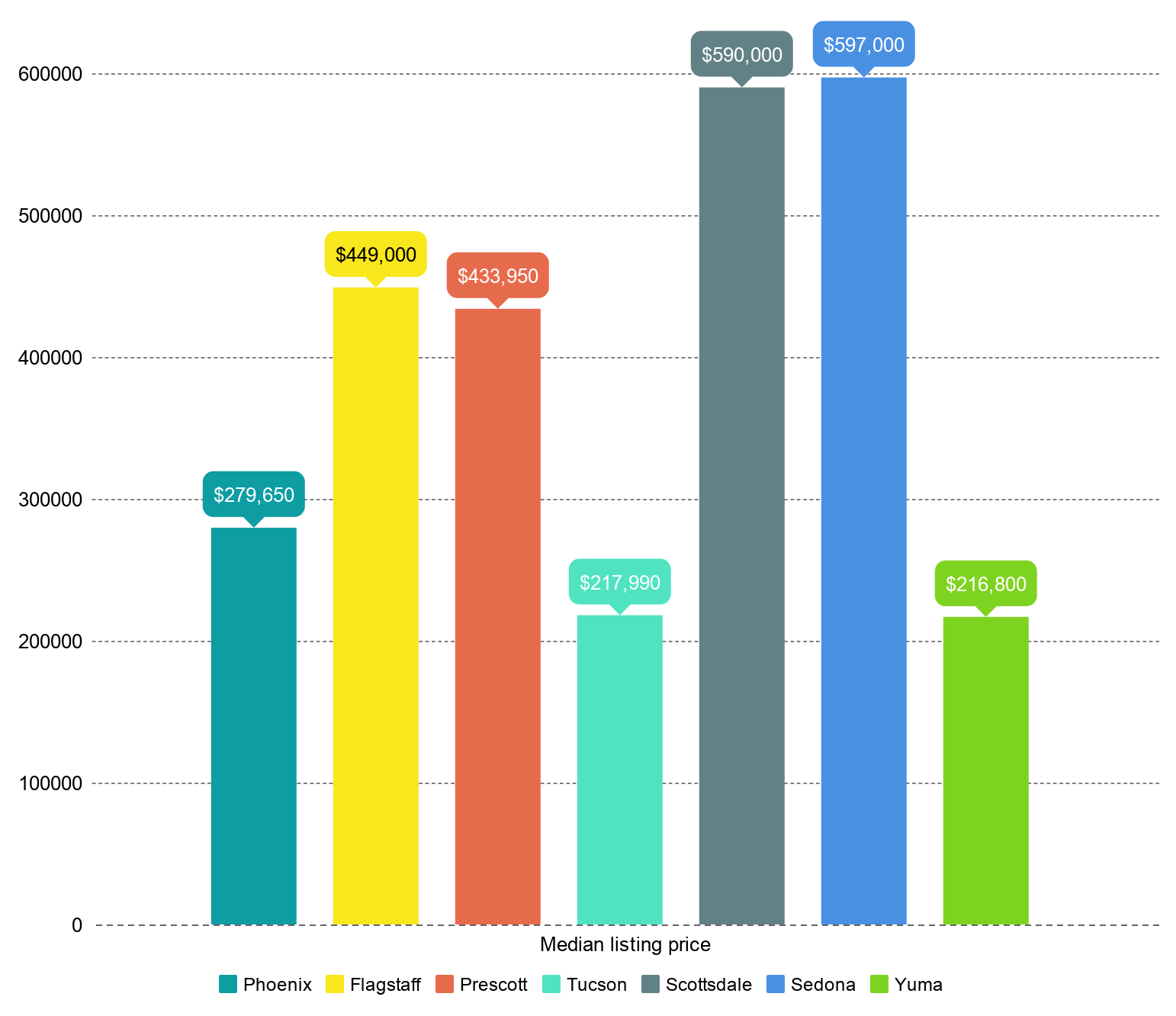

Housing Affordability Map Az Dashboard

2021 Arizona Car Sales Tax Calculator Valley Chevy

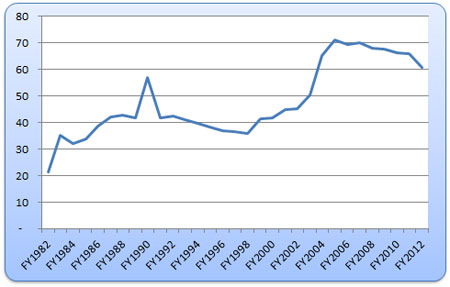

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

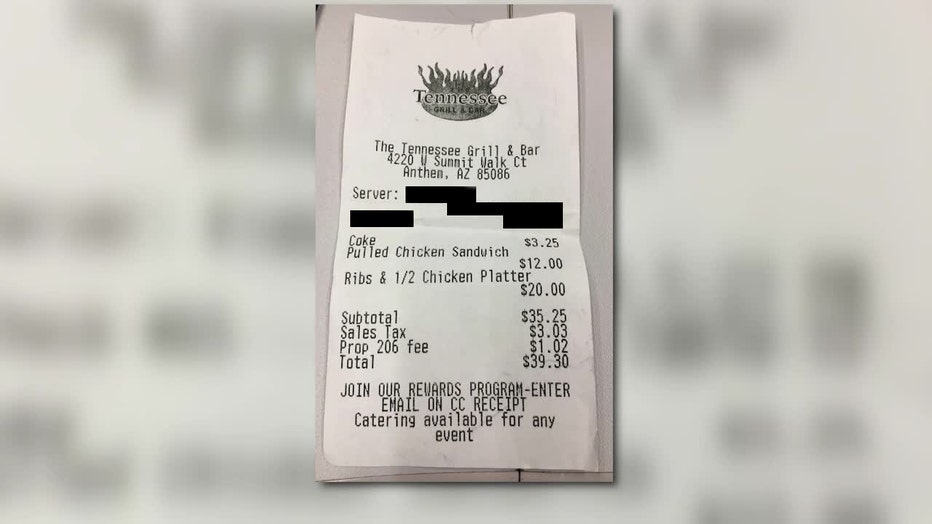

Some Restaurants Are Adding Surcharge To Bills As A Result Of Minimum Wage Increase

Industrial Space For Rent Or Lease Tucson Commercial Real Estate Group Of Tucson

Overview Of Arizona State Back Taxes Resolution Options

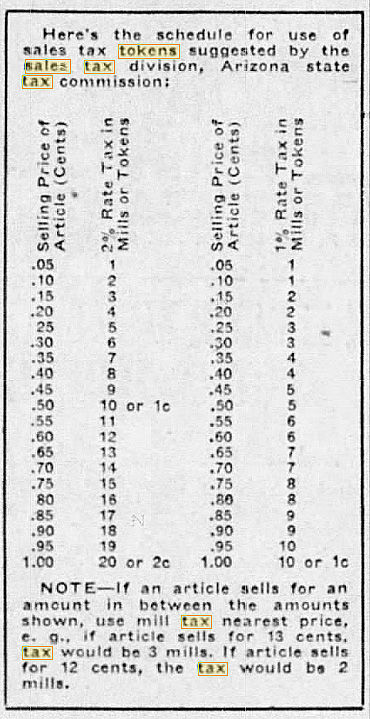

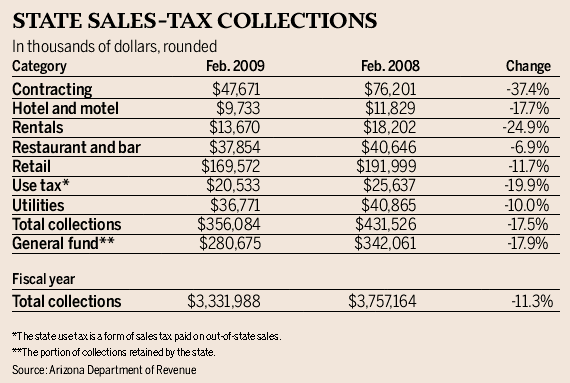

Arizona Sales Tax Collections Fell A Sharp 17 5 In February Business News Tucson Com

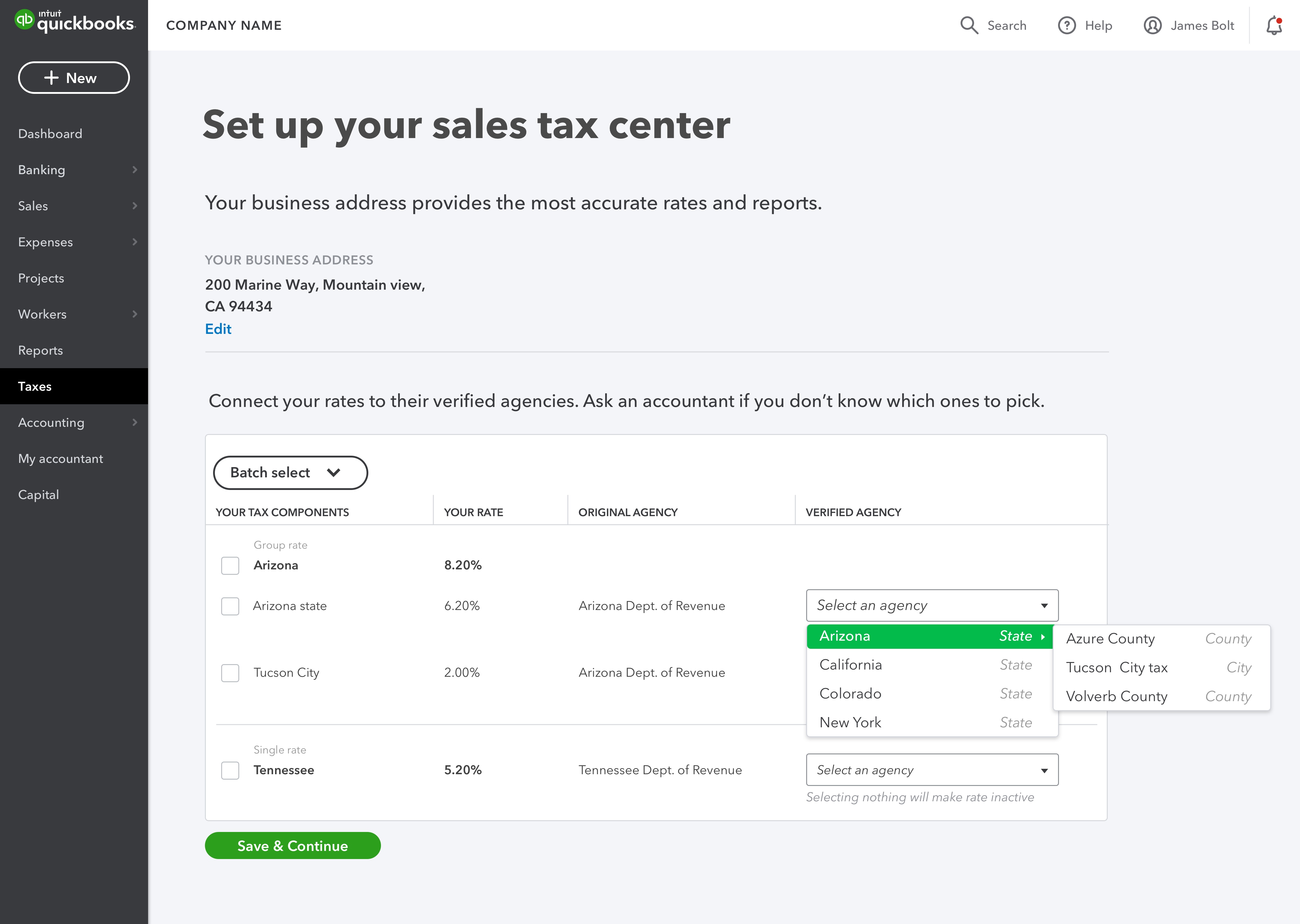

Manage Sales Tax For Us Locales

Moving From California To Arizona California Movers San Francisco Bay Area Moving Company

Report Unfair Arizona Tax System Unduly Burdens Poor Residents Cronkite News

What S New In Quickbooks Online November 2019 Quickbooks

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

Arizona Income Tax Calculator Smartasset

/https://s3.amazonaws.com/lmbucket0/media/business/i-10-s-6th-9772-1-18NYWkofpBcUA5Pgz7E5B-rJlB5KbzNfFPPzV1b3OO4.d9bbd0b40749.jpg)